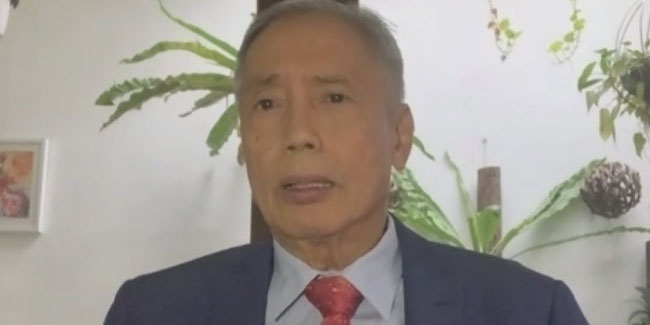

BSP Governor Felipe Medalla: “BSP is prepared to raise its policy rate by 50 basis points in August.”

BANGKO SENTRAL NG PILIPINAS — BSP Governor Felipe Medalla said that the central bank is “prepared” to increase its policy rate by 50 basis points (bps) in August.

According to Medalla, the central bank is closely monitoring developments in the financial markets, especially the Federal Reserve’s recent hawkish stance, which has caused the peso to depreciate.

“If such pressures are left unchecked, these could add to the already high domestic inflationary pressures,” Medalla said in a message to reporters. “And because of this, the BSP is prepared to be more aggressive in raising its policy rate, compared to its initial gradualist stance.”

The remarks of the BSP chief came as the Philippine peso closed at ₱56.06:$1 on Thursday, July 7.

READ ALSO: Benjamin Diokno Says President Bongbong Marcos’ Disbelief At 6.1% June Inflation “Misunderstood”

GMA News Online reported that the Bangko Sentral ng Pilipinas has already raised interest rates twice in 2022 — by 25bps in May and another 25bps in June.

Medalla also said that the central bank is ready to take further policy actions if needed.

On Tuesday, President Ferdinand “Bongbong” Marcos Jr. appeared to have cast doubt on the Philippine Statistics Authority (PSA) report that the inflation rate in June reached 6.1 percent when prices were compared to June 2021.

But Finance Secretary Benjamin Diokno, who was a former BSP governor, later clarified that the President was “referring to it as a full-year figure“.

“He was referring to it as a full-year figure when in fact the year-to-date (January to June) average inflation rate was actually 4.4 percent,” Benjamin Diokno said.

Thank you for visiting Newspapers.ph. You may express your reactions or thoughts in the comments section. Also, you may follow us on Facebook as well.