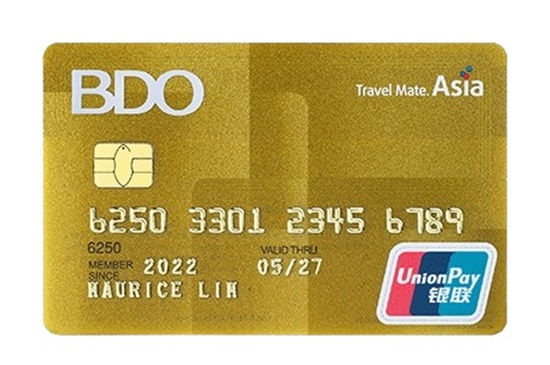

Check Here the BDO Gold UnionPay Credit Card Features

BDO GOLD UNIONPAY CREDIT CARD – You can check here the features and benefits that BDO Unibank set for the cardholders of this credit card.

More and more people have realized that there are really a lot of benefits that credit cards can bring as long as you know how to handle this type of card well. It can be your emergency preparation. In the Philippines, one of the banks with credit card offers is BDO Unibank.

The BDO Unibank is one of the reputable banks in the country. It has several accounts including loans of different types — which includes the BDO Personal Cash Loan. Aside from the loan offers, the trusted finance product and services provider also got credit card offers with excellent features like the BDO Gold UnionPay credit card.

The BDO Gold UnionPay credit card is packed with excellent features and benefits for the cardholders. Here’s a list of what awaits you by having this credit card:

- enjoy excellent perks and privileges offered in both in-store and online purchases locally and internationally

- earn Peso Points for every purchase and payment using the credit card

- FREE credit card membership for the first three (3) years

- avail up to ₱5 Million Travel Insurance coverage when you booked your travel tickets using the BDO Gold UnionPay credit card

- first supplementary card is FREE for Life; second to fourth supplementary cards free membership for the first three (3) years

- Auto Charge and Charge on Demand options make payments so much easier and convenient

- enjoy installment options with Cash-It-Easy, Balance Transfer, and Purchase Convert installment programs

- Cash-It-Easy — convert your credit limit into cash

- Balance Transfer — transfer your other card balances to your BDO Credit Card

- Purchase Convert — convert recent single-receipt purchases of at least P5,000 or $200 to installment

With regards to the credit card application, the first step is to secure that you meet the eligibility criteria set under the offer. Here are the qualifications in applying for the BDO Gold UnionPay credit card:

- at least 21 years old but not more than 60 years old upon the credit card application for Principal Cards

- at least 13 years old for Supplementary Cards

- a Filipino citizen or a foreigner resident in the Philippines

- with a minimum gross fixed monthly income of Php 33,000

To apply for the offer, there are documents that you need to prepare and submit to BDO Unibank. The lists of requirements vary depending if you are employed, self-employed, or a foreigner resident in the Philippines. It is important to gather and submit all the documents required for a higher chance of approval.

Here are the requirements in applying for the BDO Gold UnionPay credit card offer:

Employed Filipinos

- completed and signed BDO Credit Card Application Form

- any valid photo-bearing identification document like a government-issued ID e.g.:

- PhilSys ID

- Driver’s License

- SSS ID

- Passport

- applicants of Supplementary Cards who are studying may submit valid school ID

- Photocopy of latest Income Tax Return (ITR) duly stamped as received by the Bureau of Internal Revenue (BIR) or BIR Form 2316 signed by employer’s authorized representative

- any of the following:

- Latest full-month’s payslip/s

- Original Certificate of Employment indicating status, service tenure, and compensation breakdown

- if with existing credit cards, copy of the last two (2) months statements of account of credit card that is at least 1 year on books

Self-Employed Filipinos

- completed and signed BDO Credit Card Application Form

- any valid photo-bearing identification document like a government-issued ID e.g.:

- PhilSys ID

- Driver’s License

- SSS ID

- Passport

- applicants of Supplementary Cards who are studying may submit valid school ID

- Photocopy of latest Income Tax Return (ITR) duly stamped as received by the Bureau of Internal Revenue (BIR) and Audited Financial Statements for at least two (2) years

- Photocopy of registration of Business Name

- DTI Registration for Single Proprietorship or SEC Registration for Partnership / Corporation

- Last 3 months’ bank statements, optional

Foreigner Resident in the Philippines

- completed and signed BDO Credit Card Application Form

- cpy of Employment Contract or Certificate of Employment

- Letter from Embassy (if Embassy official)

- any one of the following valid documents:

- Valid VISA and work permit

- Alien Certificate of Registration (ACR) or Immigrant Certificate of Registration (ICR) or ACR-I

- valid passport with any of the following:

- Special Investors Resident VISA

- Special Non-Immigrant VISA for PEZA investors and employees

- VISA with EO226