Guide on SSS Contribution Rates 2024 for Self-Employed Members of the Social Security System

SSS CONTRIBUTION RATES 2024 – Here are the premiums that self-employed members of the Social Security System must remit every month.

It pays well to continuously post monthly contributions to the Social Security System. An active and updated membership to the SSS provides a safety net for several financially-challenging circumstances like disability, sickness, unemployment, time of calamity, etc.

Millions of Filipinos are members of the Social Security System. Across the nation, the SSS is one of the giants in terms of social insurance. Thus, a huge chunk of the Filipino populace also dedicates a part of their monthly earning to the SSS contribution.

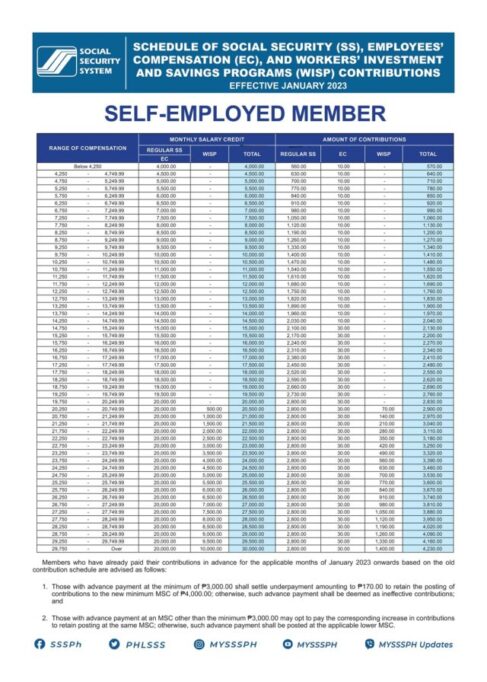

The SSS contribution rates depend on the nature of employment of the member as well as the amount earned in a month. Aside from locally-employed individuals, another huge chunk of the SSS member populace is composed of self-employed individuals.

Every year, it is wise to check on the SSS contribution rates to make sure you are paying the right premiums. Here is a guide for the rates this 2024:

SSS Salary Loan

The SSS members has a multi-purpose cash loan offer that they can turn to in times of financial need for multiple purposes. Here are the eligibility criteria under the offer:

- have posted at least 36 monthly contributions in the SSS account

- have an updated account with regards to the payment of the monthly contributions

- 65 years old and below at the time of the loan application

- are currently employed, self-employed, or voluntary member of the SSS

- has not received any final benefit from the SSS

- has not been disqualified due to fraud committed against the SSS

The Social Security System has also set a list of documentary requirements for SSS Cash Loan 2024 application.

SSS Housing Loan

The state-run social insurance institution also offers an SSS Housing Loan for the purpose of financing the house repair and home improvement projects of the qualified members. Who are qualified? Here are the qualifications for application:

- member must have posted at least 36 monthly contributions with 24 continuous contributions prior to the application

- not more than 60 years old at the time of application

- not previously granted a repair and/or improvement loan by the SSS or NHMFC

- not been granted final SSS benefits

- borrower and spouse is updated in the payment of their other SSS loan(s)

Do you want to check on the SSS Housing Loan requirements for application? The Social Security System requires a list of documents for application.

SSS Calamity Loan

Also one of the major advantages of an active membership to the Social Security System is that you will have something to turn to in times of natural disasters. Here is the eligibility criteria set under the loan offer:

- esident of an area declared under a State of Calamity

- with at least 36 monthly contributions posted to SSS, six (6) of which posted within the last 12 months before the month of the application for SSS Calamity Loan

- If self-employed, voluntary, or land-based overseas Filipino worker (OFW), member must have posted at least six (6) monthly contributions under the current coverage/membership type before the month of the application for SSS Calamity Loan

- has not availed final benefits from the SSS

- has no outstanding balance in the SSS Loan Restructuring Program (LRP) or CLAP

The loan application can be filed by the member-borrower himself/herself or an authorized representative of the member. Just make sure that the SSS Calamity Loan requirements are submitted in a complete set.