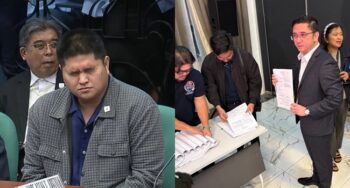

Wawao Builders Faces ₱48M Tax Evasion Case Over Ghost Flood Control Project

BIR Files Complaint Against Wawao Builders for Ghost Flood Control Project WAWAO BUILDERS – The construction company is now at the center of a tax evasion case filed by the Bureau of Internal Revenue (BIR) against its sole proprietor, Mark Allan Villamor Arevalo. The complaint, submitted to the Department of Justice, involves a tax deficiency … Read more