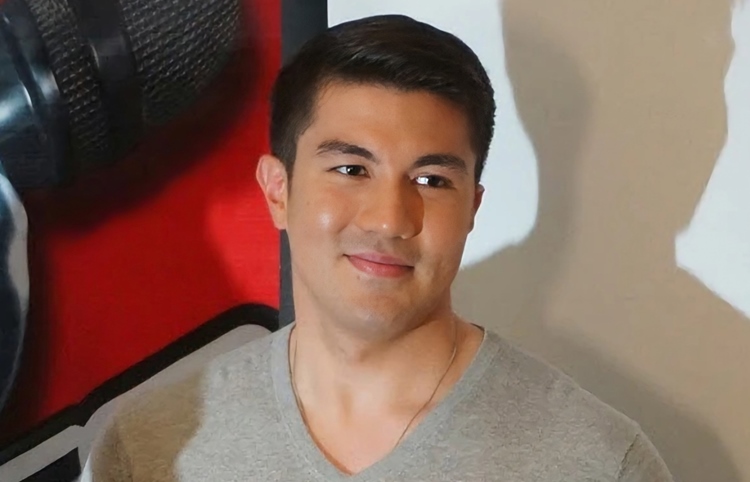

Luis Manzano Clarifies Viral Bank Tax Issue Involving Ralph Recto

LUIS MANZANO – The actor and television host came to the defense of his stepfather, Finance Secretary Ralph Recto, amidst public criticism regarding the newly implemented Capital Market Efficiency Promotion Act (CMEPA). The law, which took effect on July 1, sparked online backlash, particularly over concerns about new taxes on bank deposit interest.

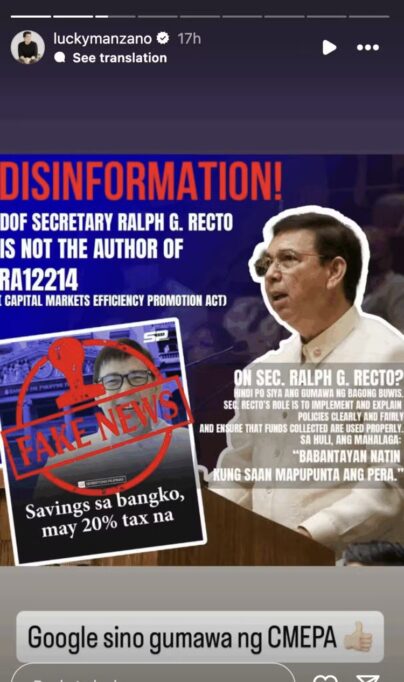

In an Instagram Story, Luis clarified that Secretary Recto did not create the controversial tax law. He explained that Recto’s role as Finance Secretary is to implement existing laws fairly and ensure that collected funds are used properly—not to draft new laws. Luis also encouraged netizens to research who actually authored CMEPA, saying, “Google who created CMEPA.”

The Department of Finance (DOF) addressed the issue as well, labeling much of the circulating information as “fake news.” The DOF clarified that CMEPA does not introduce a new tax; instead, it standardizes the existing system to make it more uniform and fair. In fact, a 20% tax on bank deposit interest has existed since 1998. Previously, certain long-term deposits (those locked in for more than five years) were exempt from this tax. Short-term deposits were taxed between 5% and 20%, depending on their duration.

Under CMEPA, all deposits are now taxed at a flat rate of 20%, regardless of how long the money is held. According to data from the Bangko Sentral ng Pilipinas (BSP), 99.6% of all bank deposits were already subject to this 20% tax, meaning only 0.4% of deposits benefited from the earlier exemptions. The new law removes these special treatments to create a fairer system for everyone.

For example, if you have P100,000 in the bank and earn 2% annual interest (P2,000), a 20% tax (P400) will be deducted, leaving you with P1,600 as your actual gain. Savings from programs like SSS, GSIS, and Pag-IBIG remain tax-exempt.

CMEPA was sponsored by Senator Win Gatchalian, who explained that the law aims to make wealth-building opportunities accessible to all Filipinos—not just big businesses.

Related Post: Carla Abellana Complains About Corruption in Real Estate Taxes