Guide on Cedula Requirements for Application Process

CEDULA REQUIREMENTS – Here are the documents needed in getting a Community Tax Certificate or more popularly called CEDULA.

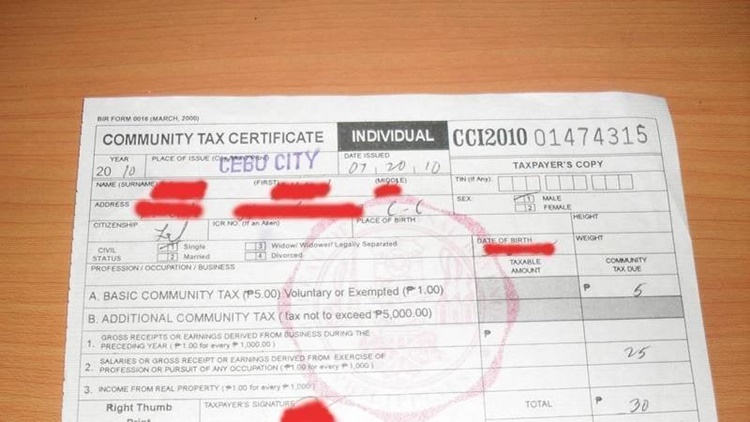

In the Philippines, there are transactions or processes that will require you to present a Community Tax Certificate. More popularly called CEDULA, it is a document that certifies that a person has paid the community tax set. It is requested from the barangay hall or the city or municipality hall.

Because the barangay halls are releasing Barangay Certificates, the Community Tax Certificate is often requested from the city hall. There are CEDULA requirements that you must prepare in obtaining this type of document.

In getting a Community Tax Certificate, there is a set of eligibility criteria. So your municipality or city hall will release the document to you, you must meet the following qualifications:

- a Philippine resident

- an employed individual who is working for at least 30 consecutive days during the calendar year

- at least 18 years of age

- a person required to file an income tax return

- a business owner who operates a witness within the municipality or city

- an individual who has a real estate property with a value of at least P1,000

The CEDULA requirements for application depend on who will get the Community Tax Certificate. A representative may get it for you but there will be a different set of documents required for application. If you wish to process it yourself, you must prepare the following documents:

- Accomplished Community Tax Declaration Form

- at least one of your valid IDs

- payslip

- proof of Income

Otherwise, if the processing will be done by a representative, here are the CEDULA requirements for application:

- Authorization letter

- valid government-issued ID

- photocopy of the valid government-issued ID of the person or business owner being represented

If you are a businessman or businesswoman, there is also a separate list of documents needed in getting a Community Tax Certificate. Here are the documents that you will need:

- Accomplished Community Tax Declaration Form

- valid government-issued ID

- approved business tax declaration as evaluated by the City Treasurer’s office