BIR Files Complaint Against Wawao Builders for Ghost Flood Control Project

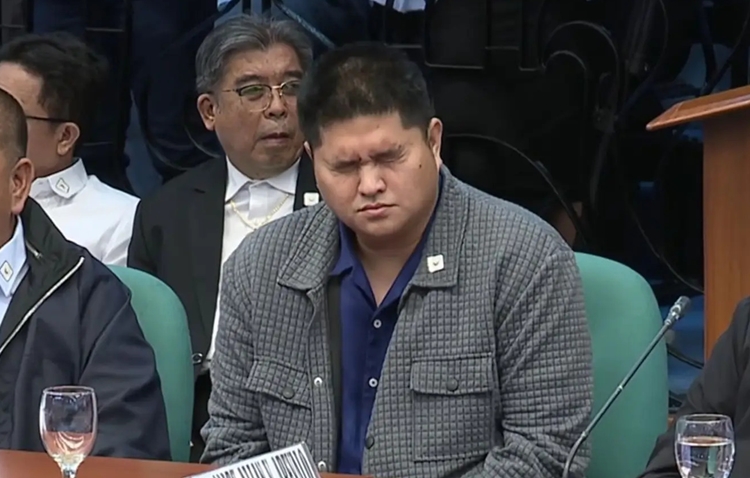

WAWAO BUILDERS – The construction company is now at the center of a tax evasion case filed by the Bureau of Internal Revenue (BIR) against its sole proprietor, Mark Allan Villamor Arevalo. The complaint, submitted to the Department of Justice, involves a tax deficiency of ₱48.39 million tied to a so-called ghost flood control project in Malolos City, Bulacan, where funds were allegedly collected for a project that was never built.

BIR Commissioner Charlito Martin Mendoza explained that Arevalo declared costs for the project in his tax returns, claiming deductions for construction expenses and operating costs. Since no actual project was carried out, these declared expenses are considered fictitious, violating Sections 254 and 255 of the National Internal Revenue Code of 1997.

The project in question was a riverbank protection structure in Barangay Caingin, awarded to Wawao Builders in January 2024 under a ₱77.20 million contract. The company reportedly collected ₱72.37 million in three payments between March and April 2025, net of withholding taxes, despite no work being performed.

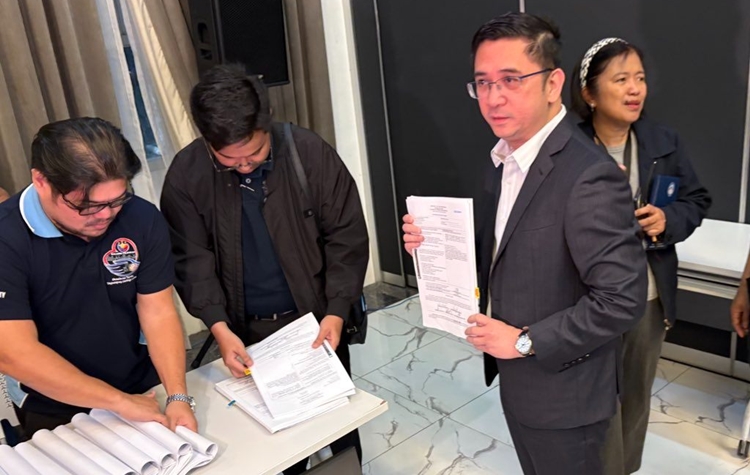

Commissioner Mendoza noted that the BIR is also investigating the possible involvement of other individuals connected to the case. Authorities are carefully ensuring that their evidence and legal basis for filing the complaint are solid before moving forward with any action.

This marks the 13th tax evasion complaint filed by the BIR related to suspicious flood control projects. Previous cases involved contractors Curlee and Sara Discaya, who face over ₱7.1 billion in tax liabilities for projects from 2018 to 2021. Former engineers from the Department of Public Works and Highways, including Henry Alcantara, Brice Hernandez, and Jaypee Mendoza, have also been included in related tax evasion cases.

Related Post: Wawao Builders Faces Charges Over ₱96.5M Ghost Project in Bulacan