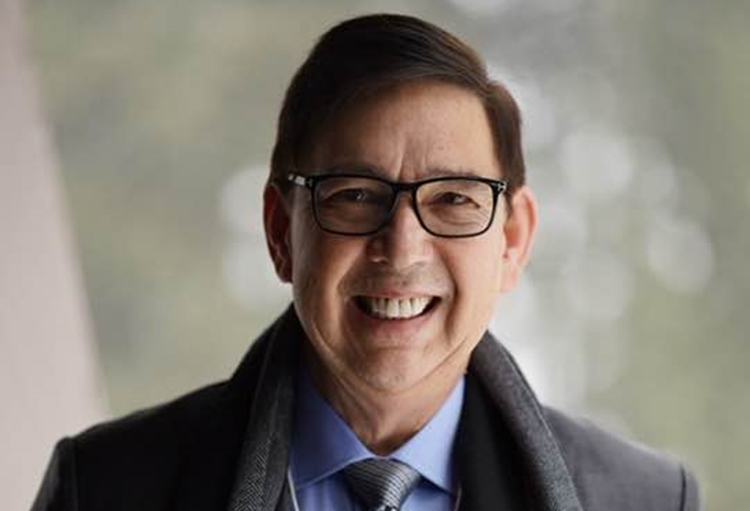

Ralph Recto Explains Why Lowering VAT Could Harm the Economy

RALPH RECTO — The Finance Secretary has warned about the possible negative effects of the proposal to lower the value-added tax (VAT) from 12% to 10%.

During a Senate hearing on October 15, 2025, Secretary Recto said that cutting the VAT rate could cause a significant drop in the government’s income. He explained that if tax collections decrease, the government might have to borrow money even for its regular expenses, which could worsen the country’s financial situation.

Recto acknowledged that the lawmakers who filed the bill have good intentions, as they aim to ease the burden of high prices on consumers. However, he also warned that if the bill is approved, the Philippines might face a credit rating downgrade — meaning the country could be seen as a higher financial risk. This would make it more expensive for the government to borrow money and could affect investor confidence. He added that while Congress has the final say, lawmakers should carefully consider the possible consequences before passing the measure.

Talks about lowering taxes grew louder after corruption issues were exposed in flood control projects, sparking public anger and renewed calls for fair and transparent use of taxpayers’ money. Many people are now urging the government to make the tax system more just and transparent.

One of the lawmakers supporting the VAT cut is Cavite 4th District Representative Kiko Barzaga, a known critic of the administration. Barzaga said that with the rising cost of living, continuous inflation, and public demand for fairness, it is time for Congress to review the VAT system. He explained that his proposal aims to reduce or remove VAT to ease the burden on Filipino consumers and increase their purchasing power.

While many agree that Filipinos need relief from high prices, Recto reminded everyone that any major tax reform must be studied carefully. He emphasized that the government should ensure such changes will not harm the economy or affect the country’s ability to provide essential public services.