Guide on SSS Contribution Rates 2024 for Locally-Employed Members of the Social Security System

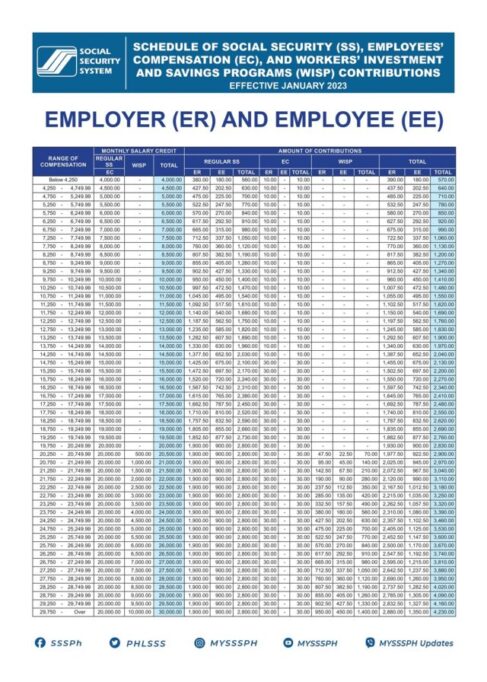

SSS CONTRIBUTION RATES 2024 – Here are the premiums that locally-employed members of the Social Security System must remit every month.

In the Philippines, the Filipinos who are employed in the private sector are mandated to have an active membership account to the Social Security System. The said government-run social insurance institution is more popularly called SSS.

The SSS has millions of members from different cities and provinces in the country. It also has members abroad — the overseas Filipino workers (OFWs) who try to maintain an active membership. Most of the members of the state entity are locally-employed individuals in the private sector.

In the case of the locally-employed members of the Social Security System, their SSS contribution rate puts a share that the employer must pay. It is important to check the premiums every year as there may be changes.

For this year 2024, here is a guide on the SSS contribution rates for members who are locally-employed in the private sector:

SSS Salary Loan

The members of the Social Security System may turn to the SSS Salary Loan in times of need for a multi-purpose cash loan offer. It is open for members who:

- have posted at least 36 monthly contributions in the SSS account

- have an updated account with regards to the payment of the monthly contributions

- 65 years old and below at the time of the loan application

- are currently employed, self-employed, or voluntary member of the SSS

- has not received any final benefit from the SSS

- has not been disqualified due to fraud committed against the SSS

Aside from the eligibility criteria stated above, you need to prepare and submit the requirements for SSS Cash Loan 2024 application.

SSS Housing Loan

The SSS members may also have the SSS Housing Loan offer that they can turn to for the financing minor and major house repairs and home improvements. Here are the qualifications for application to the offer:

- member must have posted at least 36 monthly contributions with 24 continuous contributions prior to the application

- not more than 60 years old at the time of application

- not previously granted a repair and/or improvement loan by the SSS or NHMFC

- not been granted final SSS benefits

- borrower and spouse is updated in the payment of their other SSS loan(s)

Prepare and submit the SSS Housing Loan requirements at a branch of the Social Security System should you wish to apply for the loan offer.

SSS Calamity Loan

One of the huge benefits of having an active and updated SSS account is that you have a Calamity Loan offer that you can turn to when a natural disaster strikes your place of residence or work. Here are the eligibility requirements in applying for the loan offer:

- esident of an area declared under a State of Calamity

- with at least 36 monthly contributions posted to SSS, six (6) of which posted within the last 12 months before the month of the application for SSS Calamity Loan

- If self-employed, voluntary, or land-based overseas Filipino worker (OFW), member must have posted at least six (6) monthly contributions under the current coverage/membership type before the month of the application for SSS Calamity Loan

- has not availed final benefits from the SSS

- has no outstanding balance in the SSS Loan Restructuring Program (LRP) or CLAP

In times of calamity, there is a short list of SSS Calamity Loan requirements that a member must submit in applying for the loan offer. Aside from the loan offers, the Social Security System also has benefit offers such as the following:

- SSS Unemployment Benefit

- SSS Sickness Benefit

- SSS Disability Benefit

- SSS Maternity Benefit

- SSS Retirement Benefit

- SSS Death Benefit