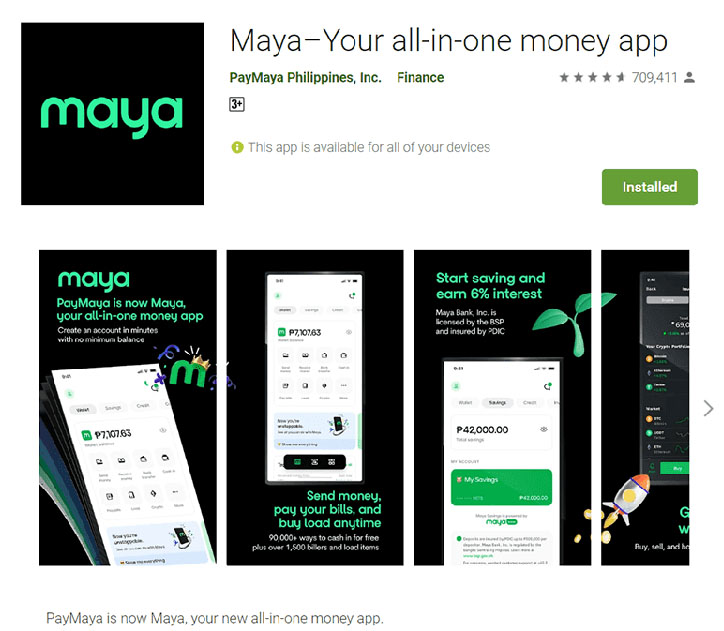

PayMaya has rebranded to Maya.

PAYMAYA — The financial technology (fintech) company has rebranded to “Maya” as the company aims to be an “all-in-one” money app.

PayMaya was rebranded into Maya as the company wants an easier name recall. This is likely an effort to get a chunk of the market that’s currently being led by its rival GCash.

The app said that “Maya is a wallet. And a bank”. To recall, Maya’s parent company, Voyager Innovations, secured a digital bank license from the Bangko Sentral ng Pilipinas (BSP) last year.

Also, the new app has a renewed focus on cryptocurrency (crypto) with “everything you need” to master one’s money.

READ ALSO: PayMaya Says Crypto Becomes Popular With Younger Filipinos

Maya said that this service is “beginner-friendly” and has ways for its users to learn the tricks and trade of the game in the said app. To recall, the fintech company recently added a new option on its app to sell or buy cryptocurrencies.

The major change in the said app is its new dark and bright green-colored logo and the more modern user interface.

Compared to the old PayMaya app, the new Maya app appears to be easier to use with an easier-to-reach button wherein users can see all of its services arranged in different categories such as Money Makers, Essentials, Payments, Lifestyle, Rewards, and more.

The early access to the Maya app major update is only available at the Google Play Store for Android users at the moment.

Those who will create a new Maya account will get a PHP 20 voucher and an extra PHP 80 after completing their accounting and sending money for the first time. Also, complete account users can buy load up to PHP 200 and get 100% cashback.

Since Maya’s savings and credit features are powered by Maya Bank, Inc., deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to PHP 500,000 per depositor.

The fintech company will hold an online event on April 29 and the public can expect them to reveal the rest of the missing details. Likely, the updated Maya app will soon be available for iOS users.

Thank you for visiting Newspapers.ph. You may express your reactions or thoughts in the comments section. Also, you may follow us on Facebook as well.