SSS MONTHLY CONTRIBUTION 2023 – Here is a list of the updated contributions to the Social Security System this year.

The SSS monthly contributions changes from time to time. The changes usually affects all members – employed, self-employed, overseas Filipino workers (OFWs), household helpers or kasambahays, employers, and voluntary members.

SSS Contribution 2023: Full List of Members Monthly Contribution Rates Based on Income

Guide on SSS Contribution 2023 for All Types of Members

SSS CONTRIBUTION 2023 – Here is a full list of the monthly contribution rates set for the members of the Social Security System this year.

In the Philippines, most individuals who are working in private companies are members of the Social Security System (SSS). It is a state-run government institution where members pay for a monthly contribution and the accumulated savings can qualify them to benefits, loans, and other services offered by the social insurance institution.

There are significant points in terms of the SSS Contribution 2023. Here are some of the key details on the changes in the SSS contribution rates this year:

- the employer contribution rate is up from 8.5% to 9.5%

- the increase is between P40 to P200 for SSS members who earn P20,000 and below

- the increase is P950.00 for SSS members who are earning P30,000 and above

- the minimum monthly salary credit (MSC) is P4,000

- the maximum monthly salary credit (MSC) is P30,000

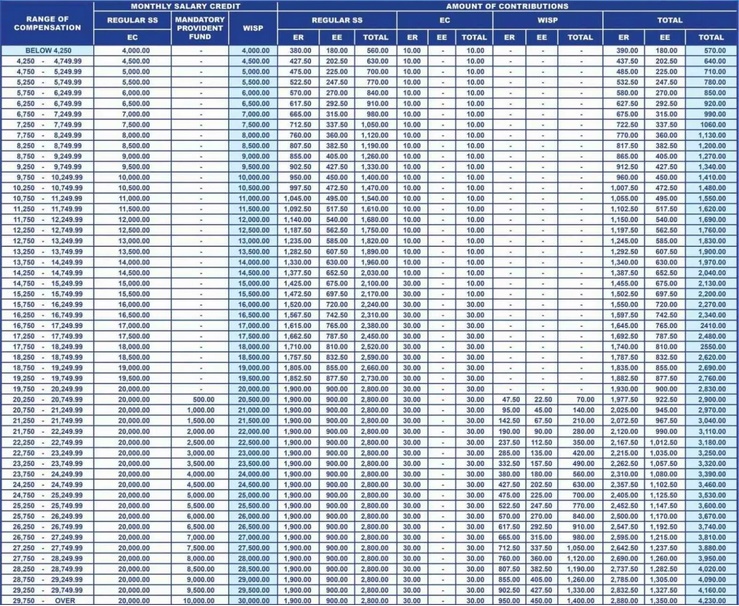

SSS Contribution 2023 for Employees of Private Companies & the Employers’ Share

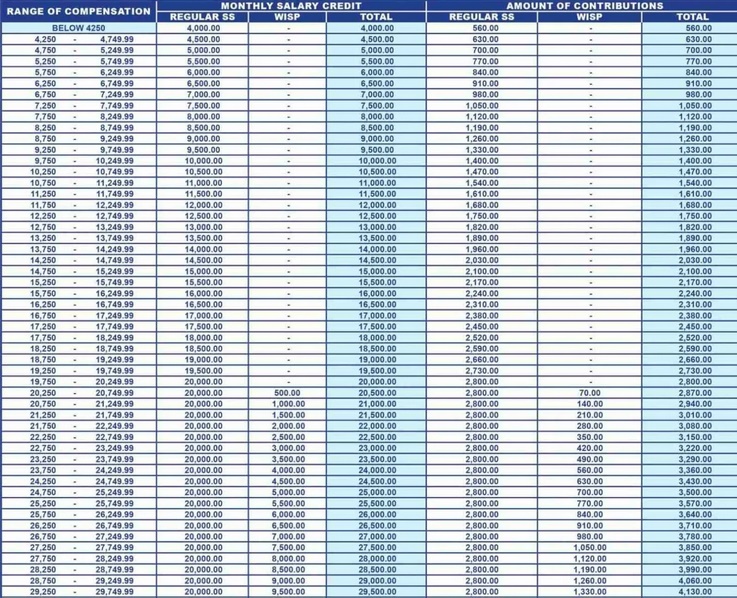

SSS Contribution 2023 for Self-Employed Members

SSS Contribution 2023 for Voluntary Members and Non-Working Spouse

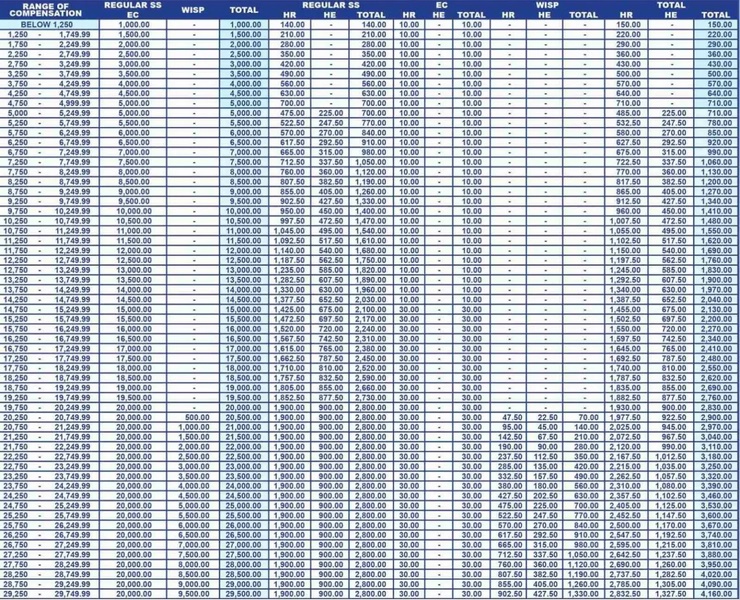

SSS Contribution 2023 for Kasambahays and Household Employers

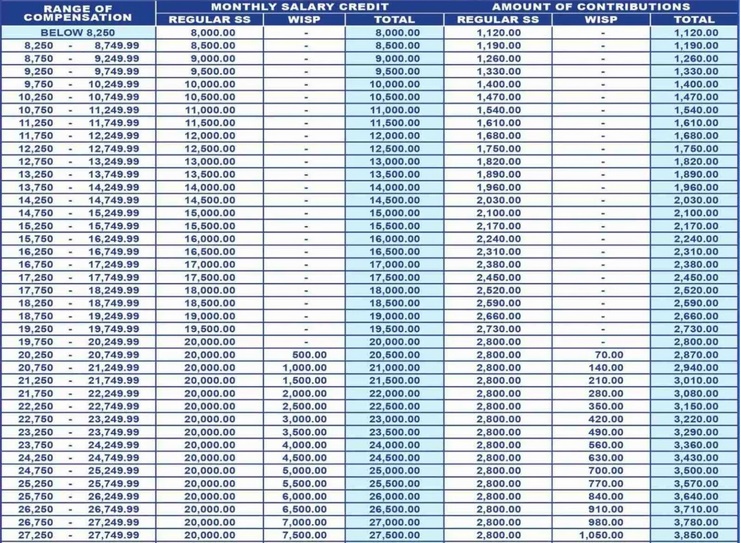

SSS Contribution 2023 for Land-Based Overseas Filipino Workers (OFWs)

Based on PhilPad, the deadline of the monthly contribution to the Social Security System for regular employers and employees; household employers; and self-employed, non-working spouse, and voluntary members is on the last day of the month while OFW members of SSS has the following deadline:

- for the contributions from January to September, you can pay for it until December 31 of the applicable year

- for contributions from October to December, the deadline is set on January 31 of the following year

You may also visit – How To Apply for SSS Salary Loan Online & the Requirements